Discover Leading Wyoming Credit: Trusted Financial Institutions

Discover Leading Wyoming Credit: Trusted Financial Institutions

Blog Article

Cooperative Credit Union: A Smart Option for Financial Flexibility

In a world where monetary decisions can considerably impact one's future, the choice of where to entrust your cash and monetary health is essential. By highlighting individualized solutions, affordable rates, and a feeling of area, credit scores unions stand out as a clever selection for those looking for economic liberty.

Benefits of Signing Up With a Cooperative Credit Union

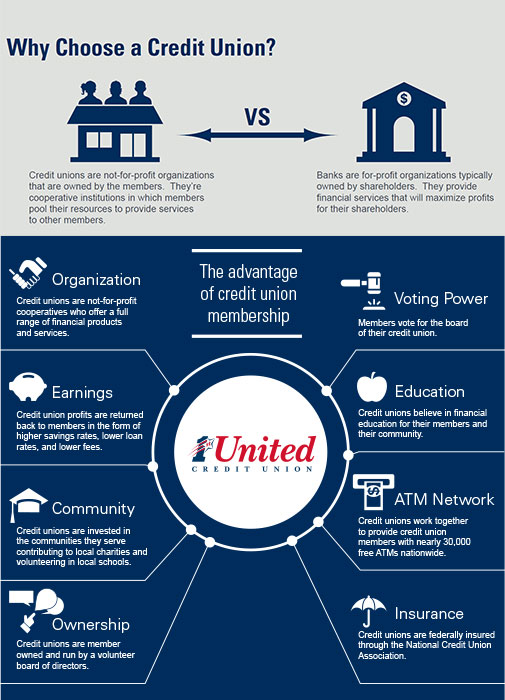

When taking into consideration monetary establishments to sign up with, individuals might locate that lending institution offer one-of-a-kind benefits that advertise economic liberty. One considerable benefit of debt unions is their focus on member complete satisfaction rather than solely on profits. As member-owned organizations, cooperative credit union focus on the requirements of their participants, commonly providing more tailored services and a more powerful feeling of neighborhood than traditional financial institutions.

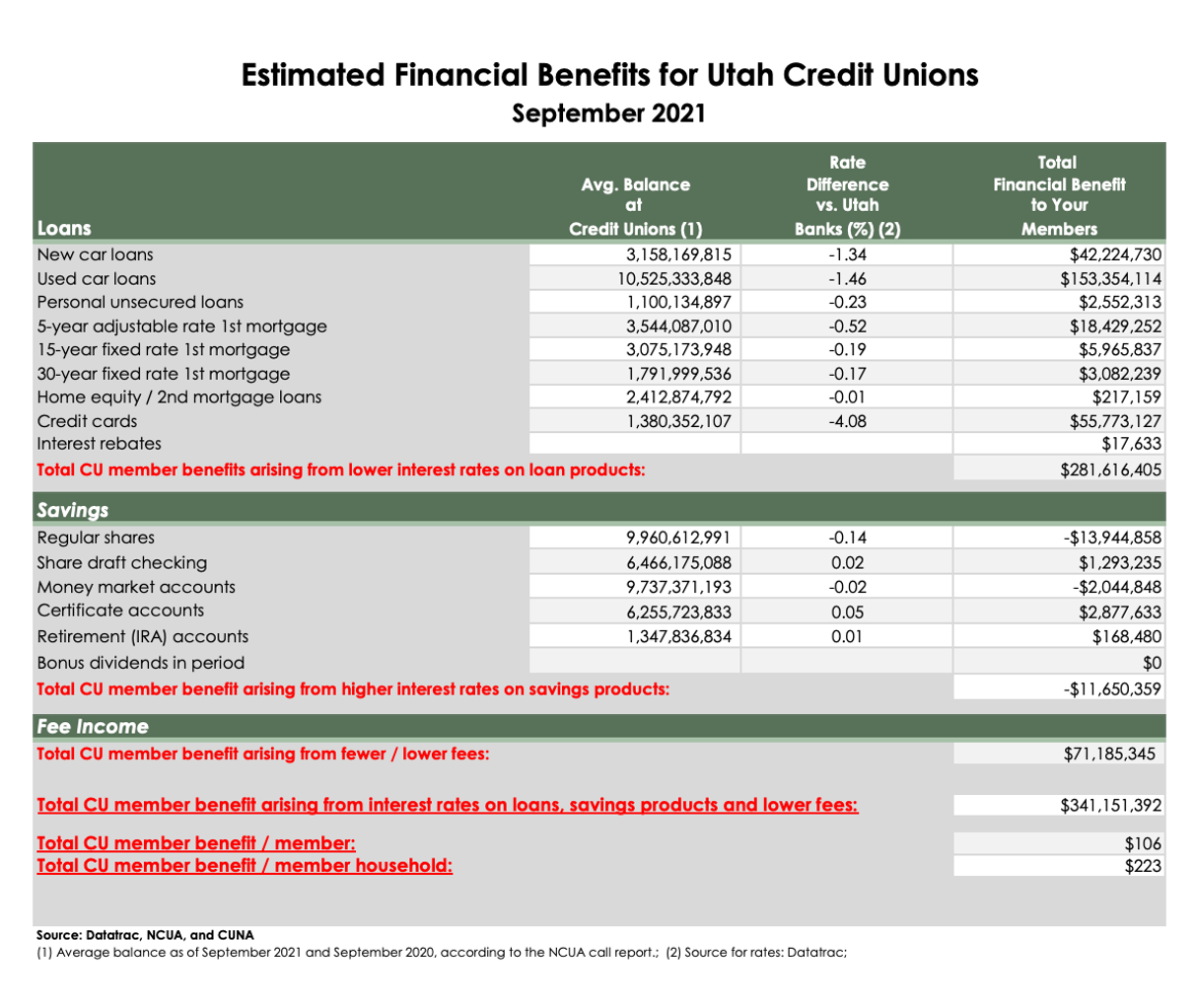

In addition, cooperative credit union normally provide affordable rates of interest on interest-bearing accounts and financings. This can result in higher returns on financial savings and reduced loaning expenses for members compared to larger financial institutions (Credit Union Cheyenne). By providing these favorable rates, credit score unions help their participants attain their economic goals extra successfully

One more advantage of cooperative credit union is their dedication to financial education and learning. Lots of lending institution use workshops, seminars, and on the internet resources to assist members enhance their economic literacy and make notified decisions regarding their money. This concentrate on education encourages people to take control of their funds, ultimately leading to greater economic freedom and safety.

Lower Charges and Better Fees

Joining a credit report union can lead to lower charges and far better rates for members seeking monetary solutions. In addition, credit report unions are known for using affordable passion prices on cost savings accounts, lendings, and credit history cards. By maintaining costs reduced and prices competitive, credit scores unions intend to assist their members save cash and achieve their economic goals extra effectively.

When it comes to obtaining money, cooperative credit union commonly provide a lot more desirable terms than banks. Participants may gain from lower interest prices on fundings for various purposes, consisting of auto fundings, home mortgages, and personal financings. These lower rates can cause substantial long-lasting savings for borrowers. By picking a credit history union for monetary solutions, people can make use of these cost-saving advantages and boost their total monetary well-being.

Individualized Customer Support

Credit score unions distinguish themselves from traditional financial institutions by providing tailored client service customized to the specific needs and choices of their participants. This tailored technique collections cooperative credit union apart in the economic market, as they focus on establishing strong relationships with their members. When you stroll right into a lending institution, you are extra than just an account number; you are a valued participant of a community-focused institution.

Among the vital facets of customized customer care at credit history unions is the ability to speak directly with well-informed staff who are bought helping you accomplish your financial objectives. Whether you are wanting to open a new account, make an application for a financing, or seek economic advice, cooperative credit union representatives are there to supply advice every action of the way (Credit Union in Cheyenne Wyoming). This customized touch includes different services, such as monetary preparation, debt consolidation, and also support during times of monetary challenge. By comprehending your unique circumstances, lending institution can use Check This Out remedies that are customized to your details demands, advertising a more helpful and favorable banking experience.

Neighborhood Participation and Assistance

Highlighting their commitment to regional areas, lending institution proactively take part in neighborhood participation and support initiatives to foster financial development and economic literacy. By taking part in neighborhood occasions, funding neighborhood programs, and supporting philanthropic companies, lending institution demonstrate their dedication to the wellness of the areas they offer. These institutions typically prioritize partnerships with regional businesses and organizations to stimulate economic growth and develop possibilities for neighborhood participants.

With financial education and learning workshops, credit history unions gear up individuals with the understanding and skills required to make enlightened choices about their funds. Additionally, they use resources such as budgeting devices, interest-bearing accounts, and budget friendly finance choices to aid neighborhood participants achieve their financial goals. By cultivating a culture of monetary Read Full Article literacy and empowerment, cooperative credit union play a vital duty in enhancing neighborhoods and promoting financial stability.

In addition, credit report unions often collaborate with schools, non-profit companies, and federal government firms to give financial education programs tailored to details neighborhood requirements. This collaborative strategy guarantees that people of all ages and backgrounds have access to the sources and support required to build a secure monetary future.

Financial Education and Resources

In accordance with their dedication to community participation and assistance, lending institution focus on providing financial education and resources to empower people in making educated economic choices. By offering workshops, seminars, on the internet sources, and one-on-one therapy, credit scores unions intend to enhance their participants' monetary proficiency and capacities. These educational campaigns cover a wide variety of subjects, consisting of budgeting, saving, investing, debt management, and financial obligation settlement approaches.

Financial education and learning outfits individuals with the knowledge and skills needed to navigate intricate economic landscapes, leading to improved monetary well-being and stability. With access to these resources, people can establish sound finance routines, prepare for the future, and job in the direction of accomplishing their monetary objectives.

Additionally, lending institution frequently work together with neighborhood institutions, recreation center, and various other organizations to expand the reach of financial education and learning programs. By involving with varied target markets and promoting monetary literacy at the grassroots degree, lending institution play a critical function in cultivating a financially educated and encouraged culture.

Conclusion

To conclude, credit scores unions offer many advantages such as reduced fees, far better rates, individualized customer support, neighborhood assistance, and monetary education - Credit Union Cheyenne WY. By focusing on participant satisfaction and financial pop over here empowerment, lending institution work as a wise choice for individuals seeking monetary freedom and security. Signing up with a cooperative credit union can aid people conserve money, attain their economic goals, and develop a solid financial future

When considering financial organizations to sign up with, people may find that debt unions provide unique benefits that advertise financial freedom. By picking a credit report union for monetary services, people can take advantage of these cost-saving advantages and boost their overall economic wellness.

In line with their devotion to area involvement and support, credit score unions prioritize offering economic education and sources to equip people in making informed financial decisions. By prioritizing participant contentment and monetary empowerment, credit history unions serve as a smart choice for people seeking financial flexibility and stability. Signing up with a credit scores union can assist individuals save cash, accomplish their monetary objectives, and develop a solid monetary future.

Report this page